Retirement Planner

Perihal Retirement Planner

Retirement Planner helps you determine how much money you will need for your retirement to maintain the current lifestyle post retirement. You can give the Current Age, Retirement Age, Current Monthly Expenses, Expected Inflation, rate of returns on your investments before retirement and rate of returns on your investments after retirement.

Features

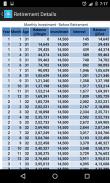

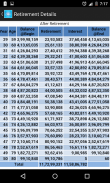

- Fields for Current Age, Retirement Age, Life Expectancy, Monthly Expenses, Inflation, Rate of Return on investment Before Retirement & After Retirement, Years to Retire, Yearly Expenses at retirement, Retirement Corpus, Monthly Investment

- Settings for Default Values - Currency Symbol, Rate of Return, Inflation, Retirement Age, Monthly Expenses & Reload Last Values

- Chart showing Monthly Investment, Yearly Retirement Income and Balance at End of every year in Retirement Corpus.

- Chart Save Chart Menu to save chart file in SD Card folder which user can attach in email.

- Hindi and Korean language added

- Existing Investment field added

- Lump sum investment required

- Monthly investment required

- Retirement Details Table with Investment required before retirement and Inflation adjusted Retirement Income after retirement.

- 2 new premium features added - Save as PDF and Email with PDF

- In app purchase for 1) App upgrade to Premium and 2) Remove ads

- Sample PDF file available at http://www.financialcalculatorsapp.com/Files/RetirementPlanner_sample.pdf

- Number formatting is now based on device locale

Age (Years) : 30

Retirement Age (Years) : 58

Monthly Expenses : 30,000

Inflation (%) : 7

Rate of Return (%) on investment Before Retirement : 15

Rate of Return (%) on investment After Retirement : 10

Year to Retire: 28

Monthly Expenses at retirement : 199,465

Yearly Expenses at retirement : 2,393,582

Retirement Corpus : 39,998,159

Monthly Investment : 7,719

Example:

Suppose you are 30 years old who wants to retire at 58 and expect to live till 80.

If your current Monthly Household Expenses (excluding expenses which will not be part of it post Retirement e.g. EMI, Insurance Premium, Education Expenses etc) are 30000,

You expect inflation to be around 7% for next 28 years,

You expect 15% return on your investments before retirement and

During retirement you expect that your investments will return 10%.

So Number of Years left for your retirement are 28 years and at retirement you will require a retirement corpus of 39,998,159 for which I need to save 7,719 per month.

Support

Please send your suggestion and issues to my E-mail address nilesh.harde@gmail.com

Retirement Planner membantu anda menentukan berapa banyak wang yang anda perlukan untuk persaraan anda untuk mengekalkan jawatan gaya hidup persaraan semasa. Anda boleh memberi Umur Semasa, Umur Persaraan, Perbelanjaan Bulanan Semasa, Inflasi Dijangka, kadar pulangan ke atas pelaburan anda sebelum persaraan dan kadar pulangan ke atas pelaburan anda selepas bersara.

ciri-ciri

- Fields untuk Umur Semasa, Retirement Age, Jangka Hayat, Perbelanjaan Bulanan, Inflasi, Kadar Pulangan ke atas pelaburan Sebelum Retirement & Selepas Bersara, Tahun ke Bersara, Perbelanjaan tahunan ketika bersara, Retirement Corpus, Pelaburan Bulanan

- Tetapan untuk Nilai lalai - Simbol mata wang, Kadar Pulangan, Inflasi, Umur Persaraan, Perbelanjaan Bulanan & Reload Nilai lepas

- Jadual yang menunjukkan Pelaburan Bulanan, Tahunan Pendapatan Persaraan dan Baki pada akhir tiap-tiap tahun dalam Retirement Corpus.

- Carta Simpan Carta Menu untuk menyimpan fail grafik dalam folder Kad SD yang pengguna boleh melampirkan dalam e-mel.

- Hindi dan Korea bahasa ditambah

- Wujud bidang Pelaburan ditambah

- Pelaburan Lump jumlah wang yang dikehendaki

- Pelaburan Bulanan diperlukan

- Retirement Butiran Jadual dengan Pelaburan diperlukan sebelum persaraan dan Inflasi diselaraskan Persaraan Pendapatan selepas bersara.

- 2 ciri-ciri premium baru ditambah - Jadikan PDF dan E-mel dengan PDF

- Dalam pembelian aplikasi untuk 1) App menaik taraf kepada premium dan 2) Keluarkan Iklan

- Contoh fail PDF boleh didapati di http://www.financialcalculatorsapp.com/Files/RetirementPlanner_sample.pdf

- Format Nombor kini berdasarkan peranti locale

Umur (Tahun): 30

Umur Persaraan (Years): 58

Perbelanjaan Bulanan: 30,000

Inflasi (%): 7

Kadar Pulangan (%) ke atas pelaburan Sebelum persaraan: 15

Kadar Pulangan (%) ke atas pelaburan Selepas Bersara: 10

Tahun ke Bersara: 28

Perbelanjaan bulanan ketika bersara: 199.465

Perbelanjaan tahunan pada persaraan: 2.393.582

Retirement Corpus: 39.998.159

Pelaburan Bulanan: 7719

contoh:

Katakan anda berumur 30 tahun yang mahu bersara pada 58 dan mengharapkan untuk hidup hingga 80.

Jika Perbelanjaan Isi Rumah Bulanan semasa anda (tidak termasuk perbelanjaan yang tidak akan menjadi sebahagian daripadanya menyiarkan Retirement cth EMI, Premium Insurans, Perbelanjaan Pendidikan dan lain-lain) adalah 30000,

Anda mengharapkan inflasi sekitar 7% untuk 28 tahun akan datang,

Anda mengharapkan 15% pulangan ke atas pelaburan anda sebelum persaraan dan

Semasa persaraan anda menjangkakan bahawa pelaburan anda akan kembali 10%.

Jadi Bilangan Tahun tinggal untuk persaraan anda adalah 28 tahun dan ketika bersara anda akan memerlukan corpus persaraan 39.998.159 yang mana saya perlu menyimpan 7719 sebulan.

sokongan

Sila hantar cadangan dan isu-isu anda ke alamat E-mel saya nilesh.harde@gmail.com